- Fed’s Preferred Inflation Gauges Cool, Reinforcing Rate-Cut Tilt

- US New-Home Sales Unexpectedly Decrease To A One-Year Low

- Canada's Muted Economic Growth Keeps Early 2024 Cut Bets Alive

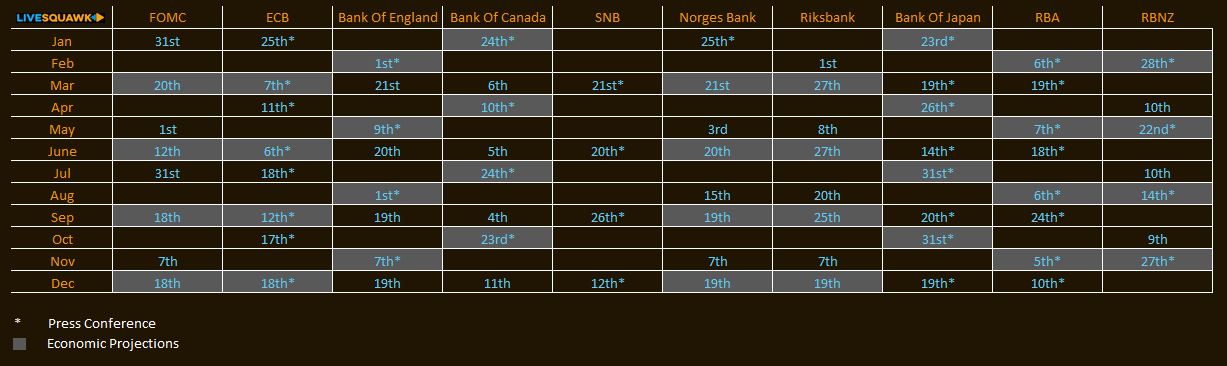

- ECB Still Has ‘Some Way to Go’ On Inflation, Schnabel Tells SZ

- UK Economy Shrinks In Third Quarter, Raising Recession Risk

- British Retail Sales Beat Forecasts Ahead Of Key Christmas Period

- No Prospect UK Rates Will Be Cut Soon, BoE’s Haskel Says

- Barclays Brings Forward Call For First BOE Rate Cut To May

- Dollar Falls To Weakest Since July As Data Fuels Rate-Cut Bets

- Oil Set For Weekly Gain As Red Sea Attacks Disrupt Global Flows

- Stocks Are Little Changed Friday, Head For 8hh-Straight Winning Week

- Bristol Myers To Buy Karuna Therapeutics For $14 Billion

- Tencent, Netease Shares Plunge After China Issues Gaming Rules

- Iranian Spy Ship Helps Houthis Direct Attacks On Red Sea Vessels

Rates of US personal consumption expenditures (PCE) were largely lower in November, adding more weight to arguments for central bank rate cuts in America in the months ahead.

The US Bureau of Labor Statistics announced Friday that the US PCE core deflator, a measure of consumer price growth said to be preferred by the US Federal Reserve, held at a monthly rate of 0.1% in November, a reading that fell short of the market expectation of 0.2%. The annual rate eased to 3.2% – the lowest since March 2021 – to come in below the 3.3% estimate and the 3.4% reading in the prior month.

US futures continued to price in the begining of Fed rate cuts in March following the news.

The headline deflator ticked higher on the month, rising to 0.1% from October’s flat reading, which was also the market forecast. The annual rate dropped to 2.6% from 2.9% in the previous month to fall below the estimate of 2.8%. (Continue Reading - LiveSquawk)

The numbers: Orders for durable goods rose 5.4% in November, the U.S. government said Friday. This is the largest gain since July 2020. It is the second gain in the past three months.

Orders were down 5.1% in the prior month. Economists had forecast a 2% rise in orders for durable goods — products made to last at least three years.

Heavy discounting by retailers appeared to encourage spending in the run-up to Christmas despite revised figures that showed the UK’s economic output underperforming over previous quarters.

Headline retail sales increased 1.3% in the month to November, an outsized gain compared with the 0.4% estimate, and well above the upwardly revised flat print in October. Annually, sales also positively surprised, growing 0.1% versus the 1.3% predicted slide and the previous month’s adjusted 2.5% fall.

Excluding fuel, sales grew at a monthly rate of 1.3% compared with an expected increase of 0.3% and October’s revised 0.2% gain. On the year, sales rose 0.3% which easily bettered the forecast 1.4% decline and 2.1% decline of the prior month.